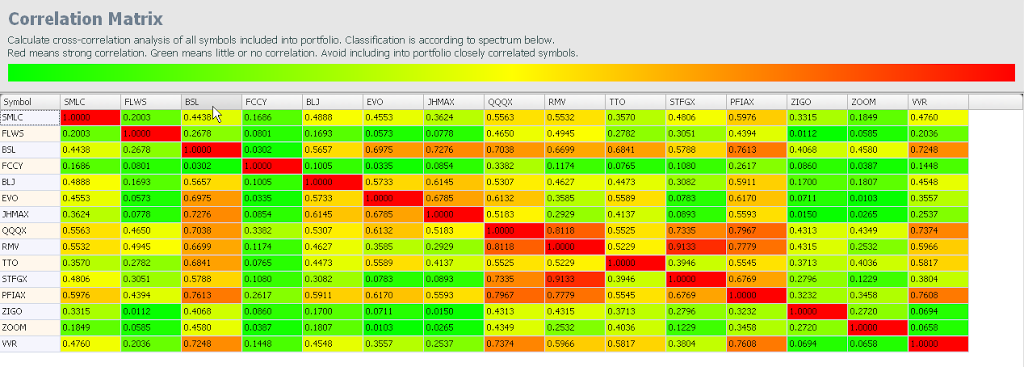

Portfolio correlation matrix is the powerful tool for your portfolio optimization. It allows optimal portfolio balancing be excluding from it closely correlated symbols. If you have several closely correlated symbols in portfolio, they similarly behave on market changes and do not add any stability to your portfolio. You must try to keep in portfolio only poorly related symbols. This generally increases portfolio stability because it will increase probability of some symbols growing when the others are on down slump.

StockFusion Studio gives you powerful option of optimizing your portfolio through correlation matrix analysis, which will highlight optimal combination of symbols in your portfolio.