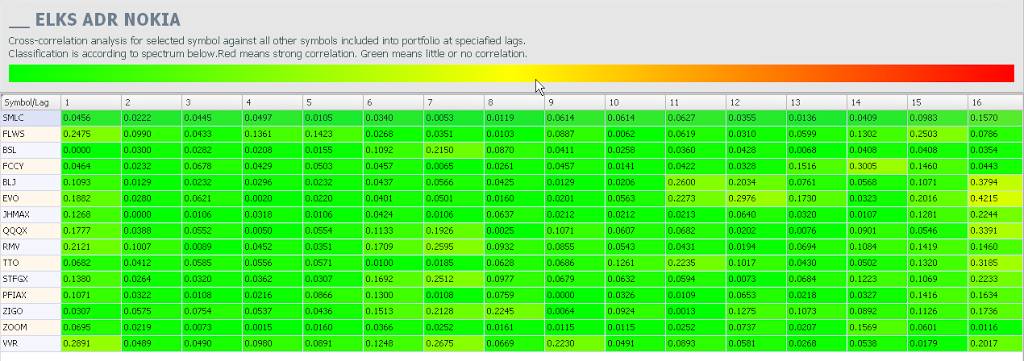

StockFusion Studio includes the powerful lag correlation matrix for discovery of symbol dependencies. It calculates cross correlation of selected symbol with other symbols over a range of time lags. If strong correlation exists, then correlated symbol can serve as a sort of predictor.

For example, we see that EKK for some reason correlates with EVO on lag 16. This means that if EVO has some price change, it is 42% likely that EKK will have very same price change in 16 trading days after that. Similar dependencies should exist intraday also.